In the relentless pursuit of profitability, business owners constantly scrutinize every line item on their balance sheet. For most commercial establishments, electricity costs are not just an expense; they are a major, volatile liability that eats into the operating budget year after year.Many decision-makers still view the installation of solar power as a ‘green’ initiative—a voluntary luxury for achieving Corporate Social Responsibility (CSR) goals. This perception is outdated and financially limiting.The reality today, especially in power-intensive markets like India, is that deploying strategic Commercial Solar Solutions is an absolute financial necessity. It is the most powerful tool available to secure energy independence and achieve massive, predictable cost reductions. This comprehensive guide will show you how businesses are using solar to slash their electricity bills by up to 70% and transform their energy cost center into a long-term asset.

1. The Cost Crisis: Why Grid Power is an Unmanageable Risk

To understand the necessity of solar, you must first acknowledge the inherent financial risks of relying solely on grid power:

- Unstoppable Price Escalation: Grid tariffs are on an upward trajectory globally, driven by rising fossil fuel costs, infrastructure investments, and transmission losses. Every year, your electricity bill costs more for the same amount of power.

- The Pain of Demand Charges: For commercial and industrial (C&I) consumers, Demand Charges are a crippling component. These are fees for the highest peak of power drawn from the grid, even if sustained only for a few minutes. They often make up 40-60% of the total bill.

- Unpredictable Supply: Despite infrastructure improvements, power quality issues, fluctuations, and outages remain a significant business risk, leading to production losses and equipment damage.

This combination of rising costs, unpredictable pricing, and supply insecurity makes your electricity bill a ticking financial time bomb. The only way to defuse it is by treating the initial solar panel cost not as an expense, but as a strategic, one-time investment that guarantees stable, low-cost power for decades.

2. The Solar Counter-Attack: Achieving 70% Bill Reduction

A strategically designed Commercial Solar Solution directly attacks the three cost factors above, leading to dramatic savings. The figure of 70% reduction is not hypothetical; it is the realized savings potential for businesses with high daytime energy use.

Core Mechanisms of Financial Gain:

- Peak-Hour Self-Consumption: Your business operates during the day, which perfectly matches solar generation hours. Every unit of electricity generated by your rooftop is a unit you do not have to buy from the expensive grid supply, especially during the costliest peak tariffs.

- Net Metering / Gross Metering Advantage: Depending on your state’s policy, surplus electricity generated is either credited against your consumption (Net Metering) or sold back to the utility at a regulated price (Gross Metering). This system turns your empty rooftop space into a passive revenue generator.

The Demand Charge Destroyer (Peak Shaving): This is the game-changer for C&I units. By integrating a Battery Energy Storage System (BESS) with your solar setup, you can store solar energy and use it to meet your maximum demand requirements, effectively performing peak shaving. This completely mitigates or drastically reduces the massive demand charges, unlocking the bulk of the 70% savings.

3. The Economics of Commercial Solar Solutions: ROI and Tax Benefits

The financial case for Commercial Solar Solutions is incredibly compelling, often outperforming traditional investments.

Financial Analysis and Payback of Commercial Solar Solutions

| Metric | Typical Commercial Solar Performance in India | Comparison |

| Payback Period (PBP) | 3 to 5 Years (Highly competitive with other capex) | Much faster than most industrial machinery. |

| Internal Rate of Return (IRR) | 18% – 25% (often tax-free return on savings) | Far exceeds average returns from FDs, bonds, and often the stock market. |

| System Lifespan | 25+ Years | After the payback period, the electricity generated is virtually free for two decades. |

| Cost Hedge | Locks energy cost at current installation price + minimal maintenance. | Provides complete insulation from 20+ years of projected tariff hikes. |

Tax and Government Incentives (A Must-Know):

In India, the government actively promotes solar adoption, especially for businesses, through powerful financial tools:

- Accelerated Depreciation (AD): Businesses can claim a high percentage of the solar system’s cost (currently 40% as per recent updates) as depreciation in the very first year of operation. This directly reduces your taxable income, lowering your tax burden and significantly improving the ROI.

- Goods and Services Tax (GST) Benefits: Businesses can typically claim Input Tax Credit (ITC) on the GST paid for the purchase and installation of the solar system.

- State-Specific Incentives: Policies in solar-forward states like Rajasthan offer generous Net Metering caps (often up to 1 MW) and exemptions from certain duties (like Electricity Duty) for a specified period, further sweetening the deal.

Ignoring these available tax and cost-saving mechanisms is essentially leaving money on the table.

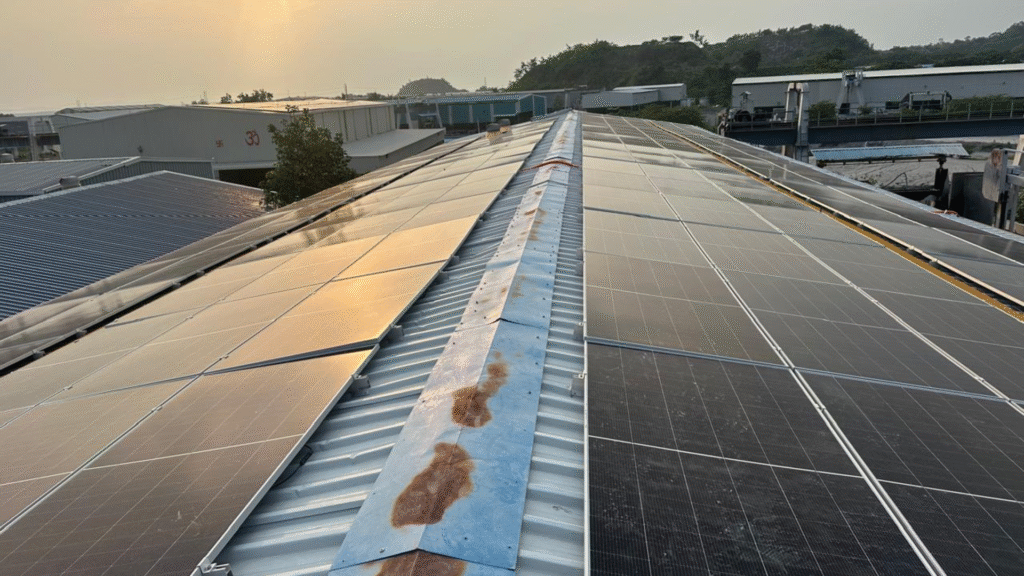

4. Advanced Technology: The Smarter Commercial Solar Solutions

Today’s solar technology is not the fragile, low-efficiency equipment of a decade ago. It is robust, intelligent, and designed for commercial resilience.

- High-Efficiency Modules (Bifacial & N-Type): Modern panels, especially Bifacial Modules, capture sunlight from both the front and back, dramatically increasing energy yield (by 10-25%) from the same rooftop area. Newer N-Type cells resist degradation better than older technologies.

- Intelligent Inverters: These devices don’t just convert DC to AC; they include sophisticated monitoring systems that detect faults, track performance unit-by-unit, and automatically optimize power flow. You can monitor your plant’s performance live on your mobile device.

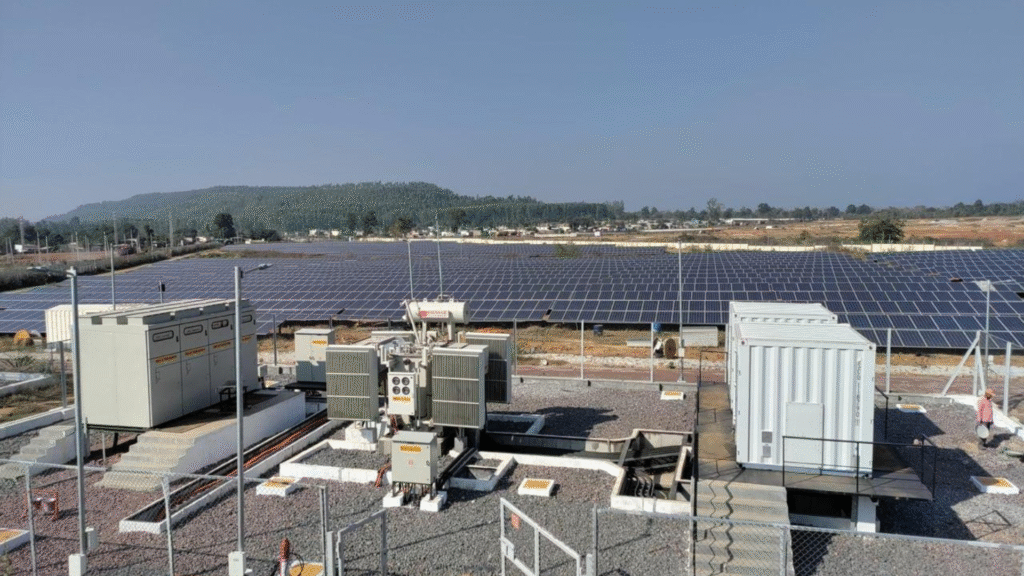

- Hybrid Systems with Storage (BESS): As discussed, the addition of battery storage is essential for high-value operations. It allows for arbitrage (storing cheap solar power and using it during expensive peak grid hours) and ensures blackout immunity.

5. Strategy Over Size: Getting the Right Fit

A successful solar project is not about having the largest system; it’s about having the most optimized solution for your unique business load profile.

Key Strategic Questions to Ask Your Provider:

- Load Analysis: What is my peak demand versus my average consumption? (Crucial for sizing against demand charges).

- Shadow Analysis: How does shade (from water tanks, AC units, or parapet walls) affect the design? (A good design maximizes output using micro-inverters or string optimizers to mitigate shading losses).

- Future-Proofing: Should I install a slightly larger system now to account for future business expansion?

- Financing Model: Should I opt for CAPEX (owning the system for maximum tax benefits) or OPEX/PPA (zero upfront cost, paying only for the cheaper solar power)?

Conclusion: A Strategic Imperative for Profitability

The decision to install Commercial Solar Solutions is the defining competitive choice of the modern era. When you can secure a long-term power rate that is significantly lower than the grid’s escalating price, and couple it with massive tax advantages, the financial return is undeniable.

This shift moves electricity from an unpredictable, rising operational cost to a predictable, stable, and revenue-generating asset. For any business serious about long-term stability, profitability, and energy independence, adopting solar is no longer a luxury to consider—it is the strategic necessity to survive and thrive.

Frequently Asked Questions (FAQ)

Q1. What is the biggest factor affecting the ROI of commercial solar? A: The biggest factor is your current commercial electricity tariff, especially the demand charges. Businesses paying higher rates (often ₹8-₹12 per unit) and facing high demand charges have the fastest payback periods (often 3 years or less).

Q2. Are there any hidden costs after installation? A: Minimal. The main operating cost is routine cleaning (which you can manage internally) and a very small amount for periodic maintenance of the inverter. Modern systems have high reliability and come with long-term performance warranties (25 years on panels, 5-10 years on inverters).

Q3. If I have a rented property, can I still go solar? A: Yes, through a Power Purchase Agreement (PPA). In this model (often considered an OPEX financing solution), a solar provider installs, owns, and maintains the system, and your business simply buys the generated solar electricity at a fixed, reduced rate (e.g., 20-30% less than your current tariff). This requires no upfront capital investment.

Q4. How long does the installation process typically take for a commercial system? A: Depending on the size (e.g., 50kW to 500kW), the installation usually takes 4 to 12 weeks from contract signing to commissioning. The actual rooftop work is often done with minimal disruption to your daily business operations.